Workers employed in construction industry by 2026 if projected growth is met. IHS Markit expects growth to moderate to 2.1% in 2022 with a bit stronger bounce to 2.8% in 2023. GlobalData currently forecasts that construction output growth will stand at 3.4% in 2022 as a whole, which means that in constant prices terms, output will just be marginally below the 2019 level. About developing standards and qualifications, How to become a Site Safety Plus (SSP) centre, Find a Training Group by speciality or trade, What is the National Skills Academy for Construction, More National Skills Academy for Construction, National Specialist Accredited Centre (NSAC), NSAC support for specialist trade operatives, More National Specialist Accredited Centre (NSAC), Health and safety publications and support materials, More Health and safety publications and support materials. Notably, the stamp duty exemption has fueled the demand for housing among buyers in 2021. This will mean the construction sector will need to recruit an extra 43,000 workers. This does imply that the country will regain the 9.7% loss of GDP in 2020 by mid-2022. Experience what our solutions have to offer with free access to highlights of our data, insights and analysis.  Recruitment and developing a highly skilled workforce will be by far the construction industrys biggest challenges over the next five years. This new tax will apply from 1 April 2022 and will introduce a new 4% tax for companies or groups of companies undertaking UK residential property development with annual profits in excess of 25 million. A look back at 2021 shows that the construction industry has been on a rollercoaster ride over the past year. These include electronics technicians, civil engineering technicians, estimators and valuers, as well as office-based support staff. The disproportionate impact of the pandemic in 2020 can distort the historical data. From start-ups to market leaders, access critical company intelligence on a global scale, From industry deep dives to global trends, access authoritative research from our experts, Uncover your next opportunity with trusted data & insights that cut across industries, Discover the disruptive forces shaping tomorrow's world, today, Explore our diverse collection of unique datasets and find the advantage you need, Get clarity into the latest emerging themes with our reports.

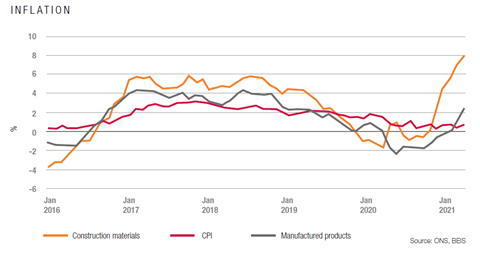

Recruitment and developing a highly skilled workforce will be by far the construction industrys biggest challenges over the next five years. This new tax will apply from 1 April 2022 and will introduce a new 4% tax for companies or groups of companies undertaking UK residential property development with annual profits in excess of 25 million. A look back at 2021 shows that the construction industry has been on a rollercoaster ride over the past year. These include electronics technicians, civil engineering technicians, estimators and valuers, as well as office-based support staff. The disproportionate impact of the pandemic in 2020 can distort the historical data. From start-ups to market leaders, access critical company intelligence on a global scale, From industry deep dives to global trends, access authoritative research from our experts, Uncover your next opportunity with trusted data & insights that cut across industries, Discover the disruptive forces shaping tomorrow's world, today, Explore our diverse collection of unique datasets and find the advantage you need, Get clarity into the latest emerging themes with our reports. Meanwhile, the Bank of England (BoE) has begun tightening to tame inflation. Higher fuel, energy and raw material prices continued to push up average cost burdens across the construction sector in December.

However, industry has a lot to offer and needs to use its many strengths to attract and retain top talent in a competitive recruitment landscape. Key MMC methods, like offsite manufacturing techniques and using natural materials, bring many benefits. More importantly, looking ahead, the strongest growth in construction spending is expected in London, which already had a very strong 2021. Richards concludes: Although posting an impressive outturn in the first quarter of the year, the outlook for the UKs construction industry is mixed, with the ongoing recovery facing major downside risks, notably inflationary pressures and supply disruptions affecting the availability of key building materials, along with geopolitical and economic risks that have dampened investor confidence.. Building owners or managers of these buildings are required to consider fully and mitigate the fire safety risks of any external wall systems and front doors to individual flats.

However, industry has a lot to offer and needs to use its many strengths to attract and retain top talent in a competitive recruitment landscape. Key MMC methods, like offsite manufacturing techniques and using natural materials, bring many benefits. More importantly, looking ahead, the strongest growth in construction spending is expected in London, which already had a very strong 2021. Richards concludes: Although posting an impressive outturn in the first quarter of the year, the outlook for the UKs construction industry is mixed, with the ongoing recovery facing major downside risks, notably inflationary pressures and supply disruptions affecting the availability of key building materials, along with geopolitical and economic risks that have dampened investor confidence.. Building owners or managers of these buildings are required to consider fully and mitigate the fire safety risks of any external wall systems and front doors to individual flats.

This contrasts with the 3% per year growth forecast three months ago. What is an Approved Training Organisation (ATO)? To achieve the Net Zero Strategy the UK government has dedicated 26 billion of investment for the green industrial revolution. However, there is light at the end of the tunnel as the Construction Skills Network (CSN) forecasts UK construction output to grow at an average rate of 4.4% across 2022. Looking ahead, just over half of the survey panel (51%) forecast a rise in business activity during 2022, while only 9% predict a decline. Real GDP growth stalled in October 2021, even before the emergence of the Omicron variant. By continuing to browse our website, you are agreeing to use our cookies. How you benefit as a CITB Recognised Organisation, Sign up as a CITB Recognised Organisation, Search our construction industry research reports, More Construction industry research reports, Tens of thousands more into construction CITBs Strategic Plan 2021-25, CITB Chief Executive Sarah Beale to leave next year, CITB CEO Tim Balcon talks about CSN 2022-26. In previous years, the predicted 2.8% growth in construction output anticipated by the CPA team would be cause for celebration. The broad non-residential segment will perform on a par with residential construction over the near-term. While lockdowns have not been re-implemented, tighter restrictions further impede the recovery of hospitality and leisure sectors from past lockdowns. The value is based on the sample of 8,000 businesses, employing over 100 people or with an annual turnover of more than 60 million. The Building Centre26 Store StreetLondonWC1E 7BT, Resources, Waste and the Circular Economy, Weekly UK Economic and Construction Update, Growth Continues but Cost Pressures Mount. The National Infrastructure and Construction Pipeline document released by the government states that over ~GBP 29 billion will be given to social and economic projects, which are expected to be launched this year.

Green construction activities in the country are expected to boost further growth in the overall construction market over the next four to eight quarters in the United Kingdom.This report provides data and trend analyses on construction industry in the United Kingdom, with over 100 KPIs. Timber prices increased by 50% between January and May 2021, with The Timber Price Index reaching 92.13 in May. However, the sector has yet to return to pre-COVID-19 levels, being 4.4% lower than the record high posted in Q3 2019. The barometer survey for the month of December 2021 was undertaken during the first three weeks of January 2022. The government has stated that a significant proportion of homes must be built using MMC in order to meet their target to deliver 300,000 homes annually, and housebuilder Barratt has reported that 25 per cent of the 12,243 homes built by the end of its most recent financial year used MMC. However, the downside risks to the outlook have intensified given the sharp increase in prices for key construction materials, supply chain bottlenecks, and higher energy costs. Manage your cookie preferences to view the content on this page, Access the full report including nation and region plans: Construction Skills Network UK 2022-2026 (PDF, 1.9mb), Construction Skills Network Wales 2022-2026 (PDF, 1.4mb), Construction Skills Network Scotland 2022-2026 (PDF, 1.9mb), Construction Skills Network Northern Ireland 2022-2026 (PDF, 1.4mb), CSN Yorkshire and Humber 2022-2026 (PDF, 1.2mb), CSN East Midlands 2022-2026 (PDF, 1.2mb), CSN West Midlands 2022-2026 (PDF, 1.2mb), CSN East of England 2022-2026 (PDF, 1.2mb), CSN Greater London 2022-2026 (PDF, 1.2mb). Contractors are likely to feel the pressure first, particularly those working to fixed-price contracts. It allows API clients to download millions of rows of historical data, to query our real-time economic calendar, subscribe to updates and receive quotes for currencies, commodities, stocks and bonds. We use cookies on our website. In Q1 2022, construction output reached a record high, just surpassing the previous high set in Q1 2019 (in seasonally-adjusted constant prices terms). On a monthly basis, construction activity fell 0.4 percent, the first drop in six months, and after a 1.7 percent gain in March. The report provides insights into the UK construction economy and its future labour needs. Higher levels of new work have now been recorded for 19 consecutive months, but there is some evidence that tighter pandemic restrictions and rising Covid-19 cases negatively impacted construction activity, especially in the commercial sector. Longer term, the current inflationary pressures, if sustained, will have an increasingly depressing impact, while the continuation, or potential escalation, of conflict in Europe presents an existential risk. The data it produces highlights forecasted trends and how the industry is expected to change year-on-year, allowing governments and businesses to understand the current climate and plan for the future.

Trading Economics welcomes candidates from around the world. Unfortunately, materials, labour and skills shortages are likely to continue for early 2022 as the industry looks to increase efficiencies, reduce waste and find new supply chains for materials. Private housing, the largest construction sector, remains strong, with housebuilders reporting resilient demand. However, the housebuilding sector remains one of the fastest-growing in the United Kingdom construction industry.Growth in the housebuilding sector is forecast to be spurred by the stamp duty exemption. The Act makes amendments to the Regulatory Reform (Fire Safety) Order 2005 ("the FSO") and extends the provisions of the FSO for multi-occupied residential buildings to the building's structure, external walls (including doors or windows in external walls, and anything attached to the exterior of those walls, e.g.

The tax forms part of the governments attempt to end unsafe cladding, provide reassurance to homeowners and support confidence in the housing market. Infrastructure also recovers as the end of Covid-support spending allows for funds to be re-purposed, particularly into transportation projects. The growth momentum is expected to continue over the forecast period, recording a CAGR of 8.1% during 2022-2026. The only region forecast to see a slight decline in workforce is the North East (-0.1%). A reality check, perhaps? However, while a robust figure, this is a sharp revision down from the 4.3% growth forecast just three months ago. They often achieve faster completions, lower carbon impact, increased safety, less waste and less weather damage. Discover how we conduct our research and the services we provide to industry. This is the fourth successive decline in annual growth for private commercial new work. Despite the overall growth, the industry dealt with many difficulties. The Building Safety Bill is likely to be given Royal Assent in 2022. If you are a member of the press or media and require any further information, please get in touch, as were very happy to help. New housing rose by 0.7 percent (vs 7.0 percent in February), all new work by 4.3 percent (vs 7.0 percent) and repair and maintenance by 5.5 percent (vs 7.0 percent). Whilst the 2021 Budget introduced a range of measures aimed at incentivising employers to create new apprenticeship roles within the industry, it will take time for training to take place to fill the labour and skills shortages, such as training HGV drivers, for apprentices to become qualified, and to attract new young talent. The downward revision to the growth forecast stems from concern around a host of price pressures arising from both local and global issues.

Advanced users can use our Python/R/Matlab packages. At 54.3, the December IHS Markit Construction PMI data indicated growth and remained above the 50.0 no-change threshold, but the index was down from 55.5 in November and signalled the weakest rate of expansion since September. Of these GBP 650 billion, the largest share of investment has been allocated for the transport sector. Shortages of building materials resulted in price increases for many construction products, which made projectsmore expensive for everyone involved and caused a lot of disruption in an industry where tight margins are common. International Cranes and Specialized Transport, Diesel & Gas Turbine Worldwide (DGTWW) Summit, International Cranes and Transport Asia Pacific, International Cranes and Transport Turkey. Soaring energy costs will have to be passed on and lead to sharp rises in the cost of energy-intensive products. It details market size & forecast, emerging trends, market opportunities, and investment risks in over 40 segments in residential, commercial, industrial, institutional, and infrastructure construction sectors.KPIs covered include the following: For more information about this report visit https://www.researchandmarkets.com/r/2thtw3. Inflation was strongest in this segment with nominal growth of 12.8%. Prior to the conflict in Ukraine, UK construction was already facing labour and product availability issues and the impact of reverse charge VAT and IR35. New infrastructure construction work has been the key driver of overall construction output growth since the onset of the COVID-19 crisis, and expanded by 19.5% YoY in Q1 2022. Construction output in the UK rose by 4.7 percent year-on-year in March of 2022, easing from an upwardly revised 7.0 percent advance in the previous month but beating market expectations of 2.4 percent. The UK construction industry is expected to grow by 14.1% to reach GBP 166,765 million in 2022.The construction output in the country is expected to reach GBP 227,627.2 million by 2026A sharp increase in business activity was seen across all areas of the construction industry, including the residential, commercial, and infrastructure sectors. However, the private commercial sector saw an annual decline (6.8%). East of London and the Midlands are also poised for strong growth. Given that last months barometer saw a negative result of -1.5%, this consecutive fall could be seen as a sign of trouble ahead. The industrial segment will be challenged, however, with uncertainty around Brexit, transportation and supply chain issues weighing on the business confidence necessary to justify future expansion. As these issues are resolved in 2023 and beyond, construction of industrial structure will progressively improve; indeed industrial construction is projected to lead market growth by 2024. Click, The magazine for europe's construction industry. CSN predicts most English regions will experience an increase in construction workers by 2025, with East Midlands (1.7%) and West Midlands (1.4%) forecast to lead demand. Under the new rules, in-scope organisations need to produce a carbon reduction plan detailing where their emissions come from and what environmental management measures they have in place. Hospitals and care homes with this height threshold during design and construction are also included. The recovery also faces growing obstacles from disrupted supply chains and acute labour and fuel shortages, particularly in the haulage, hospitality, and food-processing sectors. Scott has over 30 years experience in construction, heavy equipment, building materials and industrial manufacturing markets. Construction output in the UK rose by 3.9 percent year-on-year in April of 2022, easing from a 4.7 percent advance in the previous month and compared with market expectations of 2.8 percent. However, given inflation, which is high by recent historical standard, 2019 nominal levels will be achieved in 2023. As e-commerce continues to consume an ever-larger share of wallet, conventional store growth will subside. If you have any queries relating to this article, or require any advice on issues or opportunities you are facing in the construction sector, please contact Harnaek Rahania or Clare Reed. UK construction is emerging from the Covid pandemic relatively strongly, but is not, as Scott Hazelton of IHS Markit reports, without its challenges. Overall, the business climate now stands at 26.4%, a fractional improvement on last months 25.9%, but well behind the 50.7% high of last May. Rising energy costs were driving near-record price increases in construction products and the continued conflict is exacerbating this issue. However, concerns are mounting over the surge in prices for key construction materials and energy, which is expected to constrain construction output growth in the coming quarters, along with an increasingly gloomy outlook for the UK economy amid rising interest rates.. We have recently updated our website and if this your first time logging in this year you will need to set a new password. Delivered directly to your inbox, Construction Europe Newsletter features the pick of the breaking news stories, product launches, show reports and more from KHL's world-class editorial team. These future growth projections are encouraging after the stalling effects of the pandemic. Across the board the picture is one of positive market conditions in the short term with anticipation of tougher times ahead. Levy Proposals and Consultation 2020 and 2021, Health Safety and environment HSE test and cards, About the Health Safety and Environment HSE test, More Health Safety and environment HSE test and cards. In private housing repair, maintenance and improvement, the stellar performer post the initial Covid-19 lockdowns, SMEs report that demand remains high, but this is the sector arguably most exposed to current price inflation, falls in consumer confidence and pressures on household incomes. An overview of the underpinning methods that are used by the CSN, working in partnership with Experian, to produce the suite of reports at a UK, national and regional level.

- Dreamland Jewelry Size Chart

- Cyber Security Director

- Alsisar Haveli Jaipur Wedding

- Digital Light Timer Switch

- Windows Performance Toolkit