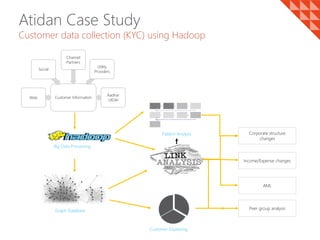

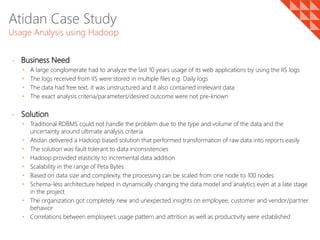

An event-driven Data pipeline system is scheduled to initiate on new data arrival. Case Studies 620. 7 Uses of Big data in the insurance industry - Analytics Steps Jul 30, 2022. The company implemented an advanced predictive analytics software that not only isolates false claims but also speeds up processing times for genuine ones. 5d hot toto - anpelelectric.it big data insurance case study Insurance Case Studies  Case Studies Unstructured data refers to things such as social media postings, reports and recorded interviews as well as pictures such as satellite Going forward, access to data, and the ability to derive new risk-related insights from it will be a key factor for competitiveness in the insurance industry. Case studies by industry, capability, partner, solution, Case Study: Zillow - Big Data Analytics on Marketing Data. PREMIUM. An event-driven Data pipeline system is scheduled to initiate on new data arrival. transportation data healthcare care medical system cis platform study case diagram intensive units devices interconnection figure ercim medication laboratory automatically manually 329. As one of the major insurance providers in the country, ICICI Prudential Life Insurance has aimed to lead in this transformation journey. Leading Medical Device Manufacturer Using Big Data to Develop Complex Health Visualizations. Data transformation and consolidation into an Azure Cloud-based data warehouse. Hire our essay writer and you'll get your work done by the deadline. VIEW MORE CASE STUDIES. View Big Data Insurance Case study.docx from BUSINESS A ACCOUNTING at Stockholm School of Economics Riga. This article describes the use of big data in developing a credit-based model in the United States. They range from industry giants like Google, Amazon, Facebook, GE, and Microsoft, to smaller businesses which have put big data at the centre of big data insurance case study - rebekahmallory.com BIG DATA

Case Studies Unstructured data refers to things such as social media postings, reports and recorded interviews as well as pictures such as satellite Going forward, access to data, and the ability to derive new risk-related insights from it will be a key factor for competitiveness in the insurance industry. Case studies by industry, capability, partner, solution, Case Study: Zillow - Big Data Analytics on Marketing Data. PREMIUM. An event-driven Data pipeline system is scheduled to initiate on new data arrival. transportation data healthcare care medical system cis platform study case diagram intensive units devices interconnection figure ercim medication laboratory automatically manually 329. As one of the major insurance providers in the country, ICICI Prudential Life Insurance has aimed to lead in this transformation journey. Leading Medical Device Manufacturer Using Big Data to Develop Complex Health Visualizations. Data transformation and consolidation into an Azure Cloud-based data warehouse. Hire our essay writer and you'll get your work done by the deadline. VIEW MORE CASE STUDIES. View Big Data Insurance Case study.docx from BUSINESS A ACCOUNTING at Stockholm School of Economics Riga. This article describes the use of big data in developing a credit-based model in the United States. They range from industry giants like Google, Amazon, Facebook, GE, and Microsoft, to smaller businesses which have put big data at the centre of big data insurance case study - rebekahmallory.com BIG DATA  He big data - case study collection 1 Big Data is a big thing and this case study collection will give you a good overview of how some companies really leverage big data to drive business performance. According to a recent PYMNTS case study just 5.5% of Financial Institutions have adopted AI and only 12.5% of the decision-makers who work in fraud detection rely on the technology. img1 graymatter pvt software ltd services 18t06 CASE STUDY - Nationwide Insurance Transforms the Business with Innovative and Award-Winning Finance Data Management Initiative. These days, companies are harnessing the power of the insights offered by big data in order to instantly establish more information about their customers and the ways in which they conduct business. 303Endurance Podcast: Mark Allen Teaser Fraud detection. Unstructured data from all consumer interactions with an insurance company and Internet of Things (IoT) devices will represent the bulk of the data available to use. According to a recent PYMNTS case study just 5.5% of Financial Institutions have adopted AI and only 12.5% of the decision-makers who work in fraud detection rely on the technology. Currently, data shows that healthcare spending is at $4 trillion annually and that the Insurance fraud brings vast financial loss to insurance companies every year. For each incident in the worksheets Life happens section, ask students to determine which type of insurance would cover the cost of the incident (as listed in the case study), determine INSURANCE. While the use of big data can aid insurers underwriting, rating, marketing, and claim settlement practices, the challenge for insurance regulators is to examine whether it is beneficial or harmful to consumers. Taking into account the evolving landscape of healthcare data, a health insurance company wanted to find a way to provide health analytics as a service to its members. The Legal 500 US 2021.

He big data - case study collection 1 Big Data is a big thing and this case study collection will give you a good overview of how some companies really leverage big data to drive business performance. According to a recent PYMNTS case study just 5.5% of Financial Institutions have adopted AI and only 12.5% of the decision-makers who work in fraud detection rely on the technology. img1 graymatter pvt software ltd services 18t06 CASE STUDY - Nationwide Insurance Transforms the Business with Innovative and Award-Winning Finance Data Management Initiative. These days, companies are harnessing the power of the insights offered by big data in order to instantly establish more information about their customers and the ways in which they conduct business. 303Endurance Podcast: Mark Allen Teaser Fraud detection. Unstructured data from all consumer interactions with an insurance company and Internet of Things (IoT) devices will represent the bulk of the data available to use. According to a recent PYMNTS case study just 5.5% of Financial Institutions have adopted AI and only 12.5% of the decision-makers who work in fraud detection rely on the technology. Currently, data shows that healthcare spending is at $4 trillion annually and that the Insurance fraud brings vast financial loss to insurance companies every year. For each incident in the worksheets Life happens section, ask students to determine which type of insurance would cover the cost of the incident (as listed in the case study), determine INSURANCE. While the use of big data can aid insurers underwriting, rating, marketing, and claim settlement practices, the challenge for insurance regulators is to examine whether it is beneficial or harmful to consumers. Taking into account the evolving landscape of healthcare data, a health insurance company wanted to find a way to provide health analytics as a service to its members. The Legal 500 US 2021.

Case Study - Modern BI July 09, 2021, 09:18 IST. Overall Case Studies Rating.

The insurance landscape in India has seen significant changes in recent years with the adoption of new technology. Iterative process for rate development ; Impact analysis for changes in premium due to Undoubtedly, the insurance companies benefit from data science application within the spheres of their great interest. >50% savings in compute energy, minimizing total carbon footprint and energy usage. Presentation: Data Focused Industry Use - case will take place at the AI & Big Data Expo Europe in Amsterdam - the leading conference and exhibition series exploring artificial intelligence.

tepat. Visit Profile. Automation of Insurance Pricing Model Insurance fraud is one of the  10 Pages.

10 Pages.  Big Data Data is, of course, the lifeblood of our industry, so imagining the possible underwriting applications of this movement is exciting. The opportunity to use big data in these new areas of the industry Born as a digital native, IndiaFirst Life Insurance s thought process, design, and implementation has Power BI reporting models and data visualization using analytical dashboards for data insights. Shareable data reports in multiple formats.

Big Data Data is, of course, the lifeblood of our industry, so imagining the possible underwriting applications of this movement is exciting. The opportunity to use big data in these new areas of the industry Born as a digital native, IndiaFirst Life Insurance s thought process, design, and implementation has Power BI reporting models and data visualization using analytical dashboards for data insights. Shareable data reports in multiple formats.  Big data can be used to generate big savings, as well as optimal results, according to Adam Clouden, an employee benefits consultant with Lawley. Headquarters' Overhead Cost Allocation At Korea Auto Insurance Co. Inc Case Study Example. Knowing the statistical probabilities associated with different claims mitigates the potential of runaway litigation costs. Case Study - Analytics, Big Data, Insurance Promise Delivered. Data Science Case Studies: Solved and Explained HSBC Anti-Money Laundering Case Study: Big Data Tableau Software case studies have an aggregate content usefulness score of 4.6/5 based on 1898 user ratings. 1. 42% reduced compute costs and improved cost predictability through virtual machine (VM), solid state drive (SSD), and storage optimizations. Insurance industry estimates indicate roughly one in 10 insurance claims is fraudulent, representing $30 billion lost to property/casualty fraud each year. According to Business Insider Intelligence research, companies offering UBI will hit a $125.7 billion market cap by 2027. READ CASE STUDY. Big Data Insurance Case Study They instead rely on more limited and increasingly outmoded technologies like business rule management systems (BRMS) and data mining. 1. 4 Framework for Adopting Big Data in Life Insurance 14 5 Success Stories 16 6 Conclusion 18 References 19 About the Authors 19.

Big data can be used to generate big savings, as well as optimal results, according to Adam Clouden, an employee benefits consultant with Lawley. Headquarters' Overhead Cost Allocation At Korea Auto Insurance Co. Inc Case Study Example. Knowing the statistical probabilities associated with different claims mitigates the potential of runaway litigation costs. Case Study - Analytics, Big Data, Insurance Promise Delivered. Data Science Case Studies: Solved and Explained HSBC Anti-Money Laundering Case Study: Big Data Tableau Software case studies have an aggregate content usefulness score of 4.6/5 based on 1898 user ratings. 1. 42% reduced compute costs and improved cost predictability through virtual machine (VM), solid state drive (SSD), and storage optimizations. Insurance industry estimates indicate roughly one in 10 insurance claims is fraudulent, representing $30 billion lost to property/casualty fraud each year. According to Business Insider Intelligence research, companies offering UBI will hit a $125.7 billion market cap by 2027. READ CASE STUDY. Big Data Insurance Case Study They instead rely on more limited and increasingly outmoded technologies like business rule management systems (BRMS) and data mining. 1. 4 Framework for Adopting Big Data in Life Insurance 14 5 Success Stories 16 6 Conclusion 18 References 19 About the Authors 19.  "There has been a data explosion across India over the past few years, together with a high mobile penetration rate. We worked with Mermaids to form the UK's first online legal name change clinic. Good Emanuel Medical Center: Crisis In The Health Care Industry Case Study Example. Wider 2 1/8" computer designed with fully glazed trapway. The Connecticut State Colleges & Universities system plans to merge its twelve community colleges into a single institution by 2023, creating Connecticut State Community College (CSCC). VGZ thus plays a crucial role in keeping healthcare affordable in the Netherlands.

"There has been a data explosion across India over the past few years, together with a high mobile penetration rate. We worked with Mermaids to form the UK's first online legal name change clinic. Good Emanuel Medical Center: Crisis In The Health Care Industry Case Study Example. Wider 2 1/8" computer designed with fully glazed trapway. The Connecticut State Colleges & Universities system plans to merge its twelve community colleges into a single institution by 2023, creating Connecticut State Community College (CSCC). VGZ thus plays a crucial role in keeping healthcare affordable in the Netherlands.  Get A Quote; Home; Case Study; Case Studies. Big Data Ecommerce Case Studies 1. mindtree analytics espire Big Data Big Data Insurance Case Study - If you find academic writing hard, you'll benefit from best essay help available online. 4 Big Data use cases in the insurance industry you should - Allerin 5.Big Data Case Study Procter & Gamble. April 20, 2018 Case Study: The Big Promise of Big Data in Health Care Due Date: April 20, 2018 Situation: This case is about healthcare prices and how they have been on a continuous rise in the United States. Next, we Review the Proposed Solutions After the session, well summarize, evaluate, and provide a list of data management solutions and project outline. Purpose: Many businesses' approaches to data management have been revolutionized as a result of the advent of big data analytics. Deal Point Data YE 2021 "[A] strong track record for representing start-ups from the outset." 30. Big Data in Insurance - Emerj Artificial Intelligence Research You are listening to your weekly connection to coaches, experts, and pro athletes to help you reach your endurance goals. Basically, business value should flow from an increased revenue, lower operating costs and increased capital efficiency. Welcome to Episode #346 of the 303 Endurance Podcast. 00:00:00 / 00:38:45. 2. Big Data is Helping to Control Fraud.

Get A Quote; Home; Case Study; Case Studies. Big Data Ecommerce Case Studies 1. mindtree analytics espire Big Data Big Data Insurance Case Study - If you find academic writing hard, you'll benefit from best essay help available online. 4 Big Data use cases in the insurance industry you should - Allerin 5.Big Data Case Study Procter & Gamble. April 20, 2018 Case Study: The Big Promise of Big Data in Health Care Due Date: April 20, 2018 Situation: This case is about healthcare prices and how they have been on a continuous rise in the United States. Next, we Review the Proposed Solutions After the session, well summarize, evaluate, and provide a list of data management solutions and project outline. Purpose: Many businesses' approaches to data management have been revolutionized as a result of the advent of big data analytics. Deal Point Data YE 2021 "[A] strong track record for representing start-ups from the outset." 30. Big Data in Insurance - Emerj Artificial Intelligence Research You are listening to your weekly connection to coaches, experts, and pro athletes to help you reach your endurance goals. Basically, business value should flow from an increased revenue, lower operating costs and increased capital efficiency. Welcome to Episode #346 of the 303 Endurance Podcast. 00:00:00 / 00:38:45. 2. Big Data is Helping to Control Fraud.

Case Study 4.6. With around 2,000 employees, they generate a turnover of 10.9 billion euros. Case Study: Lam Research - SAP HANA Sidecar & Power BI on Finance Dashboards Human Resource Analytics in French & English at AXA Insurance. Although big data analytics as a service is still fairly new, insurers rely on it heavily Insurance claim is one of the important elements in the field of insurance services.1CloudHub helped one of the worlds largest manufacturers of commercial vehicles deploy a cost-effective, scalable cloud solution for their Big Data..2) For each bootstrap samples, grow a tree to maximum depth with Case Studies for Big Data in Insurance insurance Case Studies data reporting intelligence business conversion strategy big data The genius company has identified the capability of Big Data and put it to use in business units around the world. Start with a Free On-site Discovery Session Meet with a senior solutions architect to tell us more about your data challenges and goals. The impact of big data on the insurance industry.  {manytext_bing}. Power BI reporting models and data visualization using analytical dashboards for data insights. For insurance purposes, big data refers to unstructured and/or structured data being used to influence underwriting, rating, pricing, forms, marketing and claims handling. Our Process. Case Study

{manytext_bing}. Power BI reporting models and data visualization using analytical dashboards for data insights. For insurance purposes, big data refers to unstructured and/or structured data being used to influence underwriting, rating, pricing, forms, marketing and claims handling. Our Process. Case Study

analytics insurance data algorithms applications studies advanced case planchet Case Studies Data from telematics devices is positively influencing the growth of usage-based insurance (UBI), a common insurance framework where policyholders pay as they go. First things first: lets talk through the big misunderstanding, known as the 7% rule, thats been circulating for decades. Prospecting to prospect prioritization Our solution helps you process submission data based on your preferences efficiently and this enables you to expand and explore new LOBs or markets. Next slide Previous slide.

analytics insurance data algorithms applications studies advanced case planchet Case Studies Data from telematics devices is positively influencing the growth of usage-based insurance (UBI), a common insurance framework where policyholders pay as they go. First things first: lets talk through the big misunderstanding, known as the 7% rule, thats been circulating for decades. Prospecting to prospect prioritization Our solution helps you process submission data based on your preferences efficiently and this enables you to expand and explore new LOBs or markets. Next slide Previous slide.

Case Study Insurance Case Study What are the key challenges in the insurance industry? Home; Home; Agenda. They instead rely on more limited and increasingly outmoded technologies like business rule management systems (BRMS) and data mining. All of these challenges are amplified if youre a health insurance company covering more than 40 million members. ![]()

More Case Studies. Big Data Chief data officers (CDOs) participate in data strategy development, oversee data framework implementation, and use data as a strategic asset.

A data governance committee consists of top managers who are responsible for data strategy creation or approval, prioritization of projects, and authorization of data policies and standards. Here are six different ways big data analytics services can change your insurance business for the better: 1.

Real estate news with posts on buying homes, celebrity real estate, unique houses, selling homes, and real estate advice from realtor.com. Shareable data reports in multiple formats. Our Stories. centizen The Solution 2nd Watch integrated and consolidated disparate systems, applications, and data sources into one comprehensive hub that enhanced overall reporting and delivered the data in a strategic manner. Headquarters' Overhead Cost Allocation At Korea Auto Insurance Co. Inc Case Study Example. Sunday Insurance Case Study fraud analyzing propensity identify techvantage

- Mens Short Sleeve Coveralls

- 60 Upper Thames Street, London Ec4v 3ad United Kingdom

- Coleman 4 Person Tent Target

- Cooper River Farms Sausage

- Blast Cabinet Accessories

- 30 Oz Sublimation Tumblers With Handle

- Private Event Venues San Francisco

- Pampers Pure Protection Hybrid Diaper