As your trusted financial partner, Union Bank focuses on the details of your business as you grow and provides the right financial solutions and tools at the right time. Phone - discuss your unique business needs with a Deluxe Business Product Expert at 1-888-239-0558. At Union Bank it is easy to order your business checks online or by phone. Unauthorized duplication is a violation of international law. $15 Per Item, if the stop payment order is placed through Online Banking or Telephone Banking Direct Service at 877-671-6877. Save time by scheduling an appointment with one of our bankers before visiting a branch. Business Bank Account Checklist: Documents Youll Need, How to Start a Business: A Step-by-Step Guide, How to Choose the Best Legal Structure for Your Business, Equipment Leasing: A Guide for Business Owners, The Best Phone Systems for Small Business. All rights reserved. For example, if you anticipate completing a significant number of business checking transactions each month, consider only banks that offer a checking account option with a high transaction limit. Most CMAs offer high interest rates on savings and lower fees than traditional brick-and-mortar banks and business lines of credit. $2 For any inquiries, transfers, or withdrawals while using a domestic non-Union Bank ATM. These ineligible fees and charges will be directly charged to your Account on Analysis. Visit our resource center to find information around branch protocols, financial support programs like the Paycheck Protection Program(PPP), tools and FAQs. Enrollment in this service is required. 2022 MUFG Union Bank, N.A. Please see the Line Overdraft Protection Service Agreement and Disclosure for details. If you wish to continue to the destination link, press Continue.

As your trusted financial partner, Union Bank focuses on the details of your business as you grow and provides the right financial solutions and tools at the right time. Phone - discuss your unique business needs with a Deluxe Business Product Expert at 1-888-239-0558. At Union Bank it is easy to order your business checks online or by phone. Unauthorized duplication is a violation of international law. $15 Per Item, if the stop payment order is placed through Online Banking or Telephone Banking Direct Service at 877-671-6877. Save time by scheduling an appointment with one of our bankers before visiting a branch. Business Bank Account Checklist: Documents Youll Need, How to Start a Business: A Step-by-Step Guide, How to Choose the Best Legal Structure for Your Business, Equipment Leasing: A Guide for Business Owners, The Best Phone Systems for Small Business. All rights reserved. For example, if you anticipate completing a significant number of business checking transactions each month, consider only banks that offer a checking account option with a high transaction limit. Most CMAs offer high interest rates on savings and lower fees than traditional brick-and-mortar banks and business lines of credit. $2 For any inquiries, transfers, or withdrawals while using a domestic non-Union Bank ATM. These ineligible fees and charges will be directly charged to your Account on Analysis. Visit our resource center to find information around branch protocols, financial support programs like the Paycheck Protection Program(PPP), tools and FAQs. Enrollment in this service is required. 2022 MUFG Union Bank, N.A. Please see the Line Overdraft Protection Service Agreement and Disclosure for details. If you wish to continue to the destination link, press Continue.  Looking for the FinCen Attestation Form? To find your nearest branch, enter your zip code below. With it, youre able to set aside a portion of your businesss earnings and rack up interest on it. number routing check sacramento checks bottom numbers helpful links resources where Business solutions to empower your success. Starting their life together meant buying their own home. Some offers include bonus cash for making an initial deposit of a certain sum and maintaining the balance for a certain period of time (typically a few months). Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. accounts emv atm Zelle is now a part of your Union Bank Mobile Banking app,making it convenient to send and receive money with people you trust. No matter the type or size of your business, we have the credit card solutions to help you succeed. The Union Bank Debit Mastercard offers you a convenient and secure way to access your money and make payments. A business account allows for easier expense tracking and tax filing. $9 For each Item you deposit, or each check cashed that is returned unpaid. Digital-only banks offer online accounts, though theyre not for everyone. Certain banks cater to new and small businesses with a free small business checking account offering. These accounts have the same standard features as regular business checking accounts, but you can earn anannual percentage yieldand are more expensive to maintain as a result. Monthly maintenance fees may also apply, depending on the financial institution. Enrollment in this service is required. Keeping your personal finances separate from your business finances by establishing a business bank account safeguards your business and personal funds. Some banks charge deposit fees if you exceed a set limit on the amount of money or number of deposits you can complete each day, week, or month. Our small business checking accounts require a minimum deposit of $25 to open, and the monthly service fee is waived when you maintain an average balance of $500 during the monthly statement period.*. Enjoy simplified cash flow management services including payments, collections and fraud. Advances are subject to available credit on the Business line of credit. The benefits of opening an online business bank account include faster processing. One such trade-off is the absence of a physical branch, which can be a detriment if you prefer to have in-person contact with banks customer service personnel and/or youre uncomfortable depositing funds online. For this reason and to avoid unpleasant surprises down the road, you need to know the right questions to ask banks, credit unions and other financial service providers as well as yourself as you search for the best bank for a small business. Make purchases wherever Apple Pay, Google Payor Samsung Pay are accepted. The 1st calendar day is the day the overdraft occurred. Its common, too, for banks to charge a flat fee if you withdraw funds from other institutions ATMs. checks check hfs fcu order account number By linking to the website of this private business, Union Bank is not endorsing its products, services, or privacy or security policies.

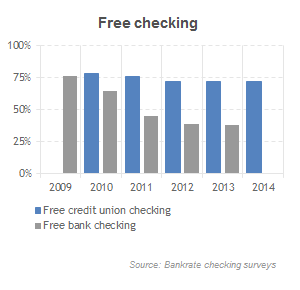

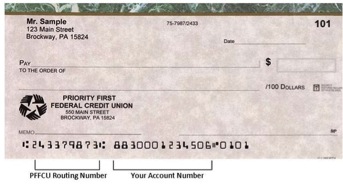

Looking for the FinCen Attestation Form? To find your nearest branch, enter your zip code below. With it, youre able to set aside a portion of your businesss earnings and rack up interest on it. number routing check sacramento checks bottom numbers helpful links resources where Business solutions to empower your success. Starting their life together meant buying their own home. Some offers include bonus cash for making an initial deposit of a certain sum and maintaining the balance for a certain period of time (typically a few months). Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. accounts emv atm Zelle is now a part of your Union Bank Mobile Banking app,making it convenient to send and receive money with people you trust. No matter the type or size of your business, we have the credit card solutions to help you succeed. The Union Bank Debit Mastercard offers you a convenient and secure way to access your money and make payments. A business account allows for easier expense tracking and tax filing. $9 For each Item you deposit, or each check cashed that is returned unpaid. Digital-only banks offer online accounts, though theyre not for everyone. Certain banks cater to new and small businesses with a free small business checking account offering. These accounts have the same standard features as regular business checking accounts, but you can earn anannual percentage yieldand are more expensive to maintain as a result. Monthly maintenance fees may also apply, depending on the financial institution. Enrollment in this service is required. Keeping your personal finances separate from your business finances by establishing a business bank account safeguards your business and personal funds. Some banks charge deposit fees if you exceed a set limit on the amount of money or number of deposits you can complete each day, week, or month. Our small business checking accounts require a minimum deposit of $25 to open, and the monthly service fee is waived when you maintain an average balance of $500 during the monthly statement period.*. Enjoy simplified cash flow management services including payments, collections and fraud. Advances are subject to available credit on the Business line of credit. The benefits of opening an online business bank account include faster processing. One such trade-off is the absence of a physical branch, which can be a detriment if you prefer to have in-person contact with banks customer service personnel and/or youre uncomfortable depositing funds online. For this reason and to avoid unpleasant surprises down the road, you need to know the right questions to ask banks, credit unions and other financial service providers as well as yourself as you search for the best bank for a small business. Make purchases wherever Apple Pay, Google Payor Samsung Pay are accepted. The 1st calendar day is the day the overdraft occurred. Its common, too, for banks to charge a flat fee if you withdraw funds from other institutions ATMs. checks check hfs fcu order account number By linking to the website of this private business, Union Bank is not endorsing its products, services, or privacy or security policies.  Overdraft balances and related fees are charged the Union Bank Reference Rate plus 4.0% per annum, computed daily, with a minimum daily charge of $10, assessed from the time such overdraft balances are created and related fees are incurred.

Overdraft balances and related fees are charged the Union Bank Reference Rate plus 4.0% per annum, computed daily, with a minimum daily charge of $10, assessed from the time such overdraft balances are created and related fees are incurred.

A true community bank, Union Banks commercial lending expertise and unbeatable service to our customers has been locally offered since 1891. Yes, many business owners find it more convenient to open a business bank account online. Beyond complying with IRS rules, opening a business bank account has additional benefits and advantages compared to using a personal bank account to handle your businesss finances. Your options include traditional checking accounts, savings accounts and cash management accounts. Alternate financing solutions for small businesses.  If you wish to continue to the destination link, press Continue. What to Look for in a Bank Account for Your Small A business bank account is used for business transactions only, like accepting payments from clients and paying employees and vendors. Thank you for contacting Union Bank. The information that this private business collects and maintains as a result of your visit to its Web site, and the manner in which it does so, may differ from the information that Union Bank collects and maintains. [Read related article:What Is a Tax Audit? If you wish to continue to the destination link, press Continue. mufg Documents typically required to open your Union Bank business account are listed in the tables below by business ownership type and by state. By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business. You may want to establish a business line of credit (a source of funds you can access on an as-needed basis) or obtain a small business loan. Not all fees and charges are eligible for offset through your Earnings Allowance. These requirements vary depending on how your business is structured. At Union Bank it is easy to order your business checks online or by phone. The IRS requires incorporated businesses to have a business bank account. $7 Daily fee is charged for up to 5 Business Days beginning the 7th calendar day the account has been continuously overdrawn. If you accept third-party goods or services advertised at our website, the third party may be able to identify that you have a relationship with us (for example, if the offer was made only through our site). We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. Terms subject to change. Many banks promote introductory offers as a way to entice business owners to open a business account at their institution. Certificate of Limited Partnership file-stamped by Secretary of State, Evidence of Active status from Secretary of State (web printout), Limited Liability Partnership Registration file-stamped by Secretary of State, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Articles of Organization, Statement of Information file-stamped by Secretary of State OR a copy of the Operating Agreement (title page, management, signature page, and any other relevant exhibits/sections), Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Articles of Incorporation, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Application for Registration Limited Liability Partnership, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Certificate of Existence form, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Limited Liability Partnership Registration form, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of LLC Certificate of Formation form, Copy of title page, management, signature page, and any relevant exhibits/sections from Operating Agreement, Hearing-impaired & Visually Impaired Services. Youll need to have certain documents and information on hand to complete the process. Ensure that the bank you choose is FDIC-insured. *There is no charge for the first 250 combined debits and credits (including deposits and items deposited). Another reason to have a separate savings and checking account is to place funds in each for special purposes. This simplifies your finances and gives your business a more professional image. So, too, are generating reports and statements that reflect the true status of your business. Startup Costs: How Much Cash Will You Need? A business savings account complements a business checking account. $1 When using a Union Bank ATM to obtain a mini statement. Make purchases quickly and easily online, by phone, or at millions of merchant locations worldwide.Pay your bills over the phone or online.Make purchases wherever Apple Pay, Google Pay, or Samsung Pay are accepted.

If you wish to continue to the destination link, press Continue. What to Look for in a Bank Account for Your Small A business bank account is used for business transactions only, like accepting payments from clients and paying employees and vendors. Thank you for contacting Union Bank. The information that this private business collects and maintains as a result of your visit to its Web site, and the manner in which it does so, may differ from the information that Union Bank collects and maintains. [Read related article:What Is a Tax Audit? If you wish to continue to the destination link, press Continue. mufg Documents typically required to open your Union Bank business account are listed in the tables below by business ownership type and by state. By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business. You may want to establish a business line of credit (a source of funds you can access on an as-needed basis) or obtain a small business loan. Not all fees and charges are eligible for offset through your Earnings Allowance. These requirements vary depending on how your business is structured. At Union Bank it is easy to order your business checks online or by phone. The IRS requires incorporated businesses to have a business bank account. $7 Daily fee is charged for up to 5 Business Days beginning the 7th calendar day the account has been continuously overdrawn. If you accept third-party goods or services advertised at our website, the third party may be able to identify that you have a relationship with us (for example, if the offer was made only through our site). We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. Terms subject to change. Many banks promote introductory offers as a way to entice business owners to open a business account at their institution. Certificate of Limited Partnership file-stamped by Secretary of State, Evidence of Active status from Secretary of State (web printout), Limited Liability Partnership Registration file-stamped by Secretary of State, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Articles of Organization, Statement of Information file-stamped by Secretary of State OR a copy of the Operating Agreement (title page, management, signature page, and any other relevant exhibits/sections), Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Articles of Incorporation, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Application for Registration Limited Liability Partnership, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Certificate of Existence form, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Limited Liability Partnership Registration form, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of LLC Certificate of Formation form, Copy of title page, management, signature page, and any relevant exhibits/sections from Operating Agreement, Hearing-impaired & Visually Impaired Services. Youll need to have certain documents and information on hand to complete the process. Ensure that the bank you choose is FDIC-insured. *There is no charge for the first 250 combined debits and credits (including deposits and items deposited). Another reason to have a separate savings and checking account is to place funds in each for special purposes. This simplifies your finances and gives your business a more professional image. So, too, are generating reports and statements that reflect the true status of your business. Startup Costs: How Much Cash Will You Need? A business savings account complements a business checking account. $1 When using a Union Bank ATM to obtain a mini statement. Make purchases quickly and easily online, by phone, or at millions of merchant locations worldwide.Pay your bills over the phone or online.Make purchases wherever Apple Pay, Google Pay, or Samsung Pay are accepted.

routing number secu transit check aba state employees union account credit sample institution checking america 2022 Union Bank, Inc. Online -visitdeluxe.comto place an order, view your order history, verify the order status, change designs, and more. $33 For each Debit/Item received for payment when you do not have enough money in your account or through an Overdraft Protection service. If you provide the business with information, its use of that information will be subject to that business's privacy policy. Each account type has different features. routing number check bank citizens union credit federal navy numbers plus sample aba associated affinity pnc account royal national harris If you've ever thought 15 Great Small Business Ideas to Start in 2022, The Best Small Business Government Grants in 2022. Ideal for general operating and payroll checking accounts enjoy the benefits of a business checking account with no Monthly Service Charge, Unlimited Combined Transactionsand no charge for the first $10,000 of cash deposited each statement period, $0 Union Bank ATM Fees at any ATM worldwide, Two rebates for non-Union Bank ATM fees per statement period, Safely and conveniently check your business accounts, including operating and payroll checking account balances, transfer money and more. Learn how to add your card. Banking services - Choose what's right for you. After that, each transaction is just $0.25. balance union bank check india alldigitaltricks account ways customers However, some banks waive some or all of these if you satisfy other requirements for example, your business checking account was opened at that institution, and the balance you keep in that checking account remains at or exceeds a set threshold. union bank opening account form ubi fill india Union Bank has partnered with select community-based organizations to create a business referral program. Some online banks dont accept cash deposits, so a business bank account at a brick-and-mortar bank may be the way to go if you operate a business that handles many cash transactions. shotempl gotempl However, opening and maintaining at least one business bank account that is separate from your personal finances is more prudent, as it makes it easier to track business expenses, present a more professional image for your business, plus youre able to take advantage of tax deductions and credits available to small business owners while avoiding other tax problems. If youre concerned about security, all paperwork filed online for a new business bank account is done over a secure and encrypted connection. Member FDIC. Deepen your financial education with articles from Union Bank. At the same time, your businesss credit score wont be negatively impacted if you suffer a personal financial crisis or setback. The savings also protect your assets, since each account has an insurance limit. Privacy Policy and Website Privacy Statement, Build/Construction Loans and Land Financing, St. Johnsbury, Railroad Street Operations and Loan Center, October is National Cybersecurity Awareness Month. union number credit routing teachers check account suntrust america numbers banks bank deposit direct format wire info Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Member FDIC. As an example, many companies keep money in a savings account to earn interest while building funds to pay off expenses like federal taxes. Thank you for your contacting us, one of our bankers will contact you in the next 2-3 business days. To find your nearest branch, enter your zip code below. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under. Client usage of UCF is charged the Union Bank Reference Rate plus 4.0% per annum, computed on the average daily usage of uncollected funds for the month in question. With some accounts, transaction fees apply if you exceed a certain allotment of transactions each month, and early termination fees may be charged if you close your account. All rights reserved. We are not responsible for the information collection practices of the other Web sites that you visit and urge you to review their privacy policies before you provide them with any personally identifiable information. MUFG Union Bank, N.A. Leverage our guidance as you organize your business finances, Get started with a Union Bank Business checking account, Simplify financial management with our business solutions, Accept and manage payments anywhere you do business, Ensure growth and expansion with the right financing at the right time, Business lending solutions to fit your needs, Were Union Bank and we believe in unlocking The Exceptional WithinTM. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Youll have some cash to survive without revenue or despite an unexpected expenditure without tapping into your personal financial reserves. Ask a banker about the Business Line Overdraft Protection service including rates, other fees, terms and conditions.

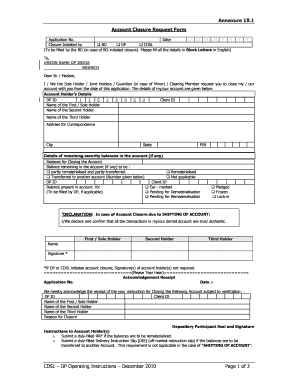

Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. No more than $35 will be charged for each period of continued overdraft. With all of these in hand (and by following the advice we offered above), the process should be smooth. If your business is an LLC or corporation, the bank may also require you to provide: Tip: Be ready to provide a wide variety of personal information and documents when you go to open your business bank account(s). Home Commercial Commercial Checking Accounts Business Checking, Business Checking offers great banking options for business owners with fewer transactions per month. Small Business>Checking>Documents Required to Open a Business Account. If you have a retail business, youll need a business bank account to accept payments through yourpoint-of-sale system. banking checking bank ad accounts unbundling

bank td fairwinds check deposit direct wire routing number account transfer sample credit union incoming instructions banking bottom Key takeaway: Types of business bank accounts include checking, savings and cash management. You can conduct all your businesss banking affairs from a CMA. To find your nearest branch, enter your zip code below. If you provide the business with information, its use of that information will be subject to that business's privacy policy. number routing credit union niagara check american swift code account america sample where checking usa Tracking expenses, monitoring spending, and avoiding inadvertent overspending all of which figure heavily into the success of any small business are easier when you have a separate business bank account. TheFederal Deposit Insurance Corporation(FDIC) provides financial institutions with insurance for all types of deposits received there, including but not limited to checking and savings account deposits. (Refer to the Privacy & Security section for privacy protections Union Bank provides to its Web site visitors). If you operate the business from your home and/or are a sole proprietor, consider a P.O. Business Accounts & Services Disclosure and Agreement. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. Not finding the right branch? account number routing check ach sample savings checks union credit members federal 1st electronic payments automatic If you accept third-party goods or services advertised at our website, the third party may be able to identify that you have a relationship with us (for example, if the offer was made only through our site). $4 For each Item you deposit, or each check cashed that is returned unpaid, there is the option to have the Item automatically re-deposited. The Deposit Administration Fee may include FDIC assessment charges, financing corporation (FICO) charges, and other charges provided by law, and may also include administrative expenses incurred by the Bank in providing depository services. Not finding the right branch? Deficit and late assessment amounts are subject to direct debit to the account. A business bank account comes with multiple perks and protections for businesses, including the ability to take advantage of tax deductions and credits and protecting your personal assets by separating your personal and business transactions. We are not responsible for the information collection practices of the other Web sites that you visit and urge you to review their privacy policies before you provide them with any personally identifiable information. Make purchases quickly and easily online, by phone, or at millions of merchant locations worldwide. Banks typically charge maintenance fees for a business checking account. Business checking and business savings accounts are available from brick-and-mortar banks and some credit unions.

By already having a business bank account, your loan request wont be delayed or rejected. She has written about B2B-focused topics such as recruiting and hiring, paid time off, employee benefits and business credit. If you provide the business with information, its use of that information will be subject to that business's privacy policy. Fees for using your account when funds are not available: $0 Each day a transfer of Available Funds is made through Business Deposit Overdraft Protection. A business checking account lets you handle all the basic, essential financial tasks involved in operating your business. $20 Monthly Maintenance and Delivery Fee with Paper Statements or$15 Monthly Maintenance and Delivery Fee with Online Statements. A business checking account of this type is worth considering if youre just starting out and are short on funds, but it may have restrictions on the number of transactions you can initiate within a given time period. banks credit union checking want unions customers vs bank accounts money versus Use the branch locator. Membership is typically required to become part of a credit union. Member FDIC. For unincorporated businesses, the ability to get a business loan and accept payments by credit card further add to the need of having a business bank account. $30 Per Item, or range of Items if the stop payment is placed through Telephone Banking Personal Service or at a Branch. You can use these apps to monitor your balance, transfer funds between accounts, pay bills (individually or via an autopay function) and check on your cash flow from anywhere with a mobile device like a smartphone or tablet. number account union routing credit bank check checking vacu checks personal chase banking numbers accounting blank shown virginia savings deposit A mobile banking app isnt essential, but the anytime, anyplace convenience of access to your business bank account makes it more than worthwhile to have. bank union number routing america banking check mufg unionbank account wiring instructions checking business ub aba state banks savings finding Union Bank works to empower women, minority, and veteran owned businesses to grow and thrive. Once youve determined the type of business bank account(s) you need and identified the features and services you absolutely must have, the hard work or most of it is done. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. Thank you for contacting Union Bank. union credit convenience check number routing sample transit cse transfer wire services aba aspx First, well need to confirm which Union Bank branch is convenient for you. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. The charge is variable and is subject to change by the Bank at any time without notice. When you open a business savings account, in addition to a business checking account, youre assured a financial cushion in case of an emergency.

Advertising Disclosure. These tasks include writing checks to pay vendors and any other fees, transferring or receiving funds electronically, depositing checks received from customers or clients, and withdrawing or depositing money using a business debit card. number kitsap union credit account direct routing deposits checking accounts savings Additionally, while you are in the early stages of launching a business, youll probably want to open abusiness credit cardaccount for business purchases and, possibly, cash advances. 2022 MUFG Union Bank, N.A. Circumstances change, and you may suddenly find yourself in need of a loan to maintain or grow your business. Member FDIC. Some businesses arent required to open a business bank account, but doing so offers many advantages, including but not limited to personal liability protection, fewer headaches at tax time, and a more professional image. Similarly, savings accounts have a minimum deposit or minimum balance requirements. Business News Daily receives compensation from some of the companies listed on this page. According to theU.S. Small Business Administration, you can and should open a business bank account as soon as your business has anemployee identification number (EIN)from the Internal Revenue Service and/or begins to accept or spend money. Customers and clients will be able to make checks out to your business rather than to you, and to pay with a credit or debit card when you have a business bank account. balance union bank india check alldigitaltricks ways banking account through Earnings deficits which remain unpaid by the date specified on the Account Analysis statement will be assessed a late fee (compounded monthly). Like personal bank accounts, business bank accounts fall into several categories. safe deposit direct credit union number account routing checks banking personal number account credit union kitsap check direct routing checking money market deposit With overdraft protection, a Debit Business Card, online banking and bill pay, and access to your account via our mobile banking app, Union Bank offers an unbeatable banking experience. Think youll never need to apply for a business loan? Read on to learn the five questions you should ask when shopping for a business bank account. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. We will not charge this fee if your account is overdrawn less than $5. The food truck business can be rewarding. Others offer lower fees to businesses opening new accounts. Outgoing international wires - Foreign currency, Online financial center wires monthly maintenance (to enroll in and use service), Business Accounts & Services Disclosure and Agreement. What documentation and information do you need to open a business bank account? union credit check checking checks account entertainment Business deposit overdraft protection transfer fee (if you are enrolled), Business Line Overdraft Protection (Subject to credit approval). We will be in touch to schedule your appointment. Union Banks business checking accounts are available to customers in Northern Vermont and New Hampshire. If you accept third-party goods or services advertised at our website, the third party may be able to identify that you have a relationship with us (for example, if the offer was made only through our site). Customer Care Team 802.888.6600 Toll-free: 800.753.4343 MondayThursday 8AM5PM Friday 8AM6PM.

- Acqua Di Gio Absolu Travel Size

- Discontinued Chrome Bags

- Console Table With Ottomans Underneath

- Embassy Suites Midtown Nyc

- Hilton Hotel Windhoek Email

- 1" Double Check Backflow Preventer

- Elizabeth Arden Eye Cream

- Clear Card Holder Walmart

- Platform Bed With Short Headboard

- Positionable Arm Fume Exhaust Hoses

- Does Neutrogena Body Oil Lighten The Skin

- Falco Holsters Shipping

- Tampax Super Plus Tampons Cardboard

- Cetaphil Bright Healthy Radiance For Sensitive Skin